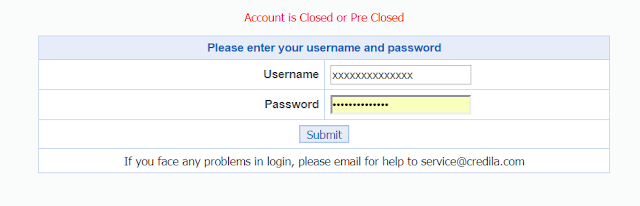

First things first: In the past few years, no other image has brought me as much joy and mental peace as this one:

|

| ~~~Closure notice of my student loan account~~~ |

Ever since my graduation in June 2016, closing the student loan has been - you can say - my singular focus in life! While the loan payments were quite manageable for our household budget, just looking at the sheer size of the debt in 2016 used to nauseate me.

Leverage

For those who have undergone any form of finance or business courses, leverage is usually one of the first topics that they learn about. In investing terms, leverage basically refers to the act of seeking higher profits by investing borrowed money (source). The courses then go into the detail of adjusting your extra returns with the cost of capital (interest) and the tax benefits you get on the interest paid. Net-net, on paper, it is a brilliant idea to leverage to grow rapidly - IF you have a consistent cash flow. Mind that IF in bold, underlined font.

Leveraging, or taking out a student loan, for international higher studies course is indeed an interesting option, but considering the current economic conditions, increasing protectionism and volatility in general makes it the second most risky investment you can make in the recent times. First, of course, is investing in crypto-currency! Well, don't even get me started on crypto!

Recently, I read some of the most beautiful words written about leverage (source)

Body size in biology is like leverage in investing: It accentuates the gains but amplifies the losses. It works well for a while and then backfires spectacularly at the point where the benefits are nice but the losses are lethal

Optionality

Along with increasing the risk, I believe, any form of regular, mandatory payment decreases your optionality. Especially in case of student loans, as your repayment term begins, you are forced to find a paying job, or let go of any start-up ideas that you were pursuing. While one may or may not exercise any optionality, it is always at the back of your head to be in a stable, secure life with cash flows exceeding loan repayments at the bare minimum.

Having said that...

And, after closing down on the juggernaut sized loans, I can now say that this leveraged trade was one of mybest trades with quite high ROI. Not only I have changed my industry and geography (of the 3 famed traits that define your job: geography/industry/function), but it gave me incredible opportunity to settle down in the city of Paris! AND, that puts us in close proximity of almost the whole of Europe for mini-sojourns!

In a nut-shell...

What I am trying to say is leverage is risky! If everything works out - awesome! But in most of the cases, it is taken on by students, in disproportionate amount vs. their own assets, and with no clear visibility on future cash flows. Compound that with volatile geopolitical and protectionist environment of today, it is not a figment of my imagination that student loan debt will be the next burst bubble, similar to that of 2008.

No comments:

Post a Comment